In recent weeks, Ethereum has shown subtle signs of recovery amid a generally weak cryptocurrency market, with altcoins mimicking Bitcoin’s gradual upward trend.

Although the price of Ethereum has increased slightly by 0.2% in the past 24 hours, similar trends are unfolding behind the scenes that could have a major impact on Ethereum’s economic model.

Reduced ETH burn due to lower network activity

In April, Ethereum’s ETH burn rate hit its lowest point in a year, mainly due to a significant decrease in network transaction fees.

These fees have typically fluctuated at just under 10 Gwei this year, but have fallen to their lowest levels in recent weeks, directly impacting the burn rate of ETH.

This reduction in burn rate is evidenced by a significant drop in daily burnt ETH, reaching a low of 671 ETH in the past day, a notable drop from the daily numbers of 2,500-3,000 ETH seen earlier this year. decreased.

This decrease in burn rate is not just a statistical anomaly, but reflects broader changes within the Ethereum network.

A major factor contributing to lower gas prices is gas price increases. Migration of network activity to a Layer 2 solutionincreasing transaction speed while reducing costs.

Plus innovations such as: BLOB transactionwas introduced in Ethereum’s recent Dencun upgrade to further optimize the cost of these secondary layers.

In particular, Blob is a feature introduced to enhance Ethereum’s compatibility with layer 2 solutions such as zkSync, Optimism, and Arbitrum by efficiently managing data storage needs. This feature is part of the Dencun upgrade and integrates proto-danksharding via EIP-4844.

While these technological advances are beneficial in reducing transaction fees, they pose challenges to Ethereum’s deflationary mechanism.

This upgrade introduces a new fee structure that eliminates base fees that are part of all transaction fees, potentially reducing the overall supply of ETH. However, lower transaction fees have weakened the expected deflationary pressures from burning, suggesting a shift towards a more inflationary trend in the short term.

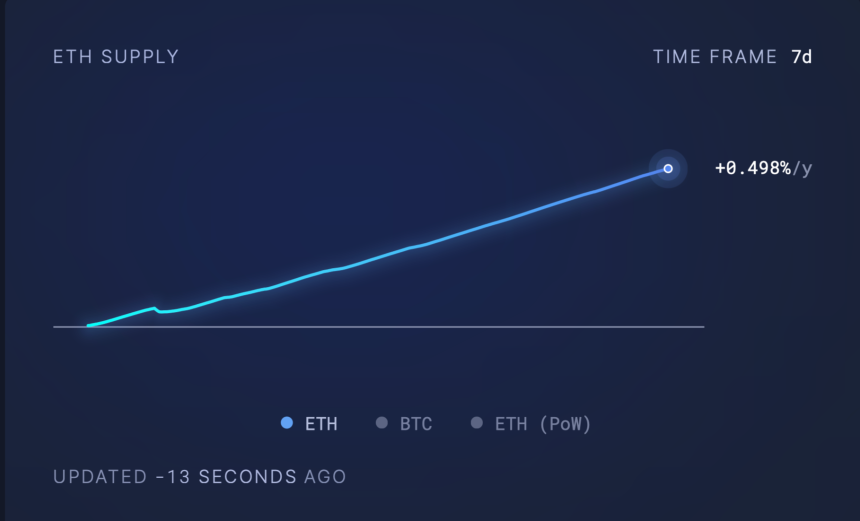

According to Ultrasoundmoney, Ethereum’s supply dynamics have shifted to moderate inflationary mode with a growth rate of 0.498%. As network activity intensifies, this change may readjust, increasing transaction fees and, as a result, burn rates.

Ethereum market reaction

Despite these underlying network dynamics, Ethereum’s market price has struggled to regain its previous highs above $3,500. The asset is trading around $3,085, reflecting a slight decline in recent weeks.

This price movement highlights the market’s broader reactions to internal network changes and external economic factors, such as regulatory battles with the U.S. Securities and Exchange Commission (SEC) and macroeconomic uncertainty.

Looking to the future, the evolution of Ethereum’s gas fees and subsequent ETH burn rate will be important in determining the sustainability of its economic model.

Featured image from Unsplash, chart from TradingView